The dance of generation and demand

Flexibility is the defining principle of tomorrow’s electricity market: Helen Steiniger analyses the transition from inflexible concepts of the past to the dynamic electricity markets of the future.

Traditionally, the so-called merit order was intended to deliver reserve power to the network at the lowest possible cost. In this paradigm, load was assumed as given and supply was continuously adjusted to meet demand. Base load plants, usually large coal/lignite-fired or nuclear units, ran flat and covered the minimum load throughout the year. To meet hourly, daily and seasonal demand, mid-range units were dispatched for short periods.

Nowadays, in places like Germany, Denmark, California etc., renewables, especially solar and wind, comprise more than half of total generation on many days and hours. But they must be utilized when they are available – otherwise their low-cost, carbon-free electricity is wasted.

This article reflects about a radically different operating and dispatching paradigm: Instead of taking load as given, why not assume that demand and supply are flexible and can be adjusted to dance together, rather than forcing one to follow the other?

Flexibility in the Context of Variable Renewable Generation

In Germany, roughly one third of power generation in 2016 was supplied from renewables with an overwhelming portion of wind, biomass and solar energy. The variable energy sources wind and solar have a significant impact on the power grid: Wind generators in the windy North often produce so much electricity that the grid transporting it to the industrial South gets congested. Grid operators deal with this situation by paying thermal or renewable units in the north to switch off – and paying thermal units in the South to ramp up. The costs for curtailing or switching off renewable plants almost doubled from €43.7 million in 2013 to €82.7 million in 2014 and then multiplied to €478 million in 2015 before decreasing by 22 percent to €373 million in 2016.The expected effect of so much variable generation on the network is twofold:

- First, it tends to depress overall wholesale prices because renewables displace thermal generation with zero marginal cost while thermal capacity is shut down in a lower pace than renewable capacity is built, leading to overcapacities in the market.

- Second, variability of renewable generation tends to make wholesale prices volatile because large swings in wind and solar generation impact market price spreads.

The first expected effect brought significant consequences in Germany, especially for the four German power utilities: Their thermal plants are dispatched less frequently and for fewer hours at low market prices on average while many of them cannot be ramped down to zero, further depressing prices when running on minimum load. A trend which is likely to get worse: recent studies estimate that up to 230 GW of fossil capacity in Europe will remain unprofitable through 2020.* Still, a lot of nuclear and coal/lignite capacities are kept in the market through direct and indirect subsidies – a paradoxical outcome at odds with the EU’s climate goals.

The second expected effect cannot be so easily detected in the German market. The German electricity markets very efficiently deal with the fluctuating nature of wind and solar, so that prices do not necessarily become more volatile. Nonetheless, renewables have immensely altered the price structures of wholesale markets, for example by breaking up the peak/off-peak paradigm of the old energy world.

Combined, the net effect of these two phenomena – wholesale prices plummeting and the peak/off-peak differential eroding – is to:

- make thermal plants with inflexible operational characteristics less profitable

- make the grid operators job more challenging as the task of keeping supply and demand in balance requires new thinking, new tools and new approaches.

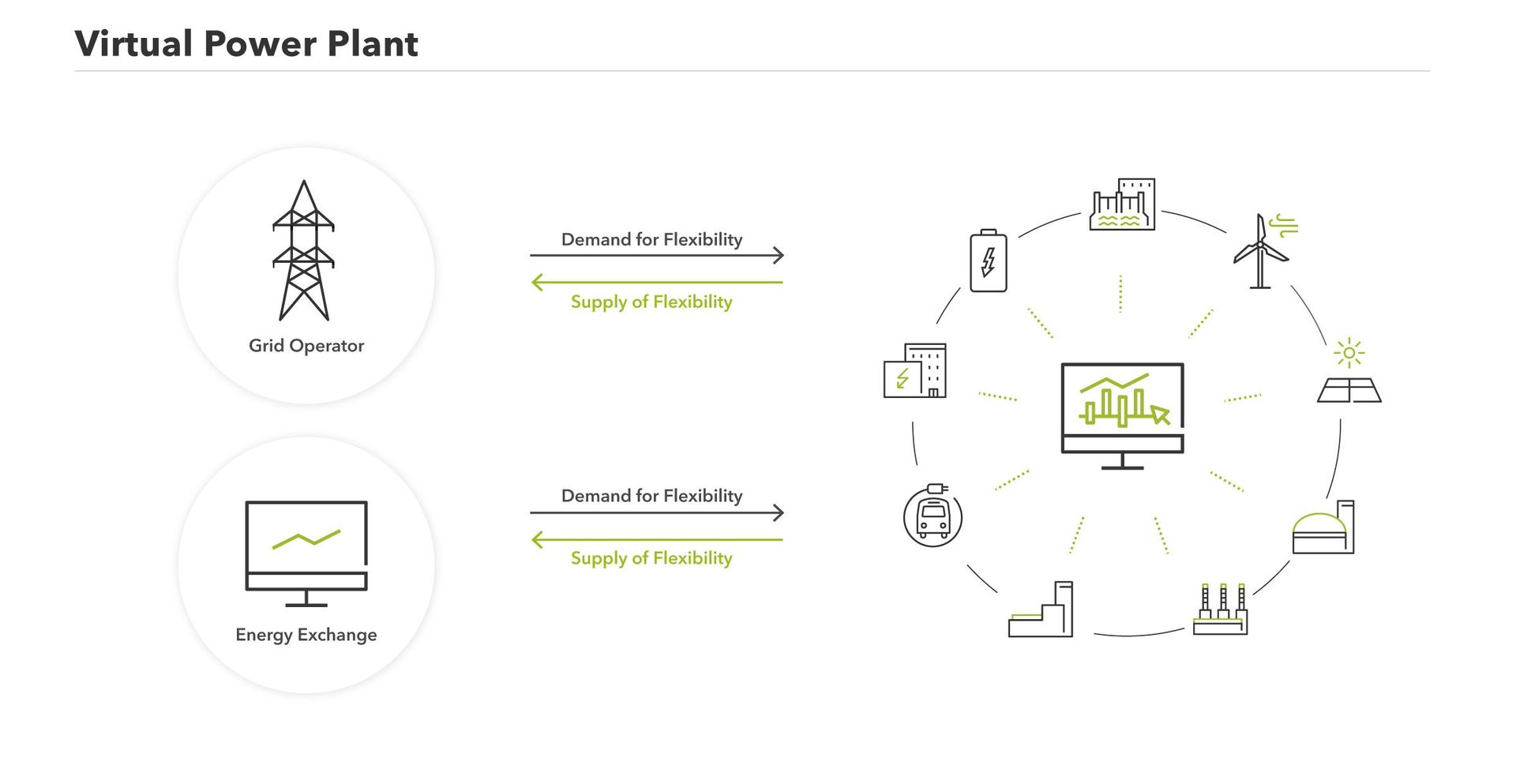

VPPs and the role of aggregators

As we can see from the preceding discussion, business as usual is not likely to be sustainable. The up- and down-ramping of thermal plants causes a lot of wear and tear on the units and is hugely inefficient, expensive and polluting.

Obvious solutions to these problems are:

- better manage the variable generation to the extent possible

- foster flexible renewable generation alongside variable renewables; and

- make demand more flexible and price-responsive.

We at Next Kraftwerke are trying to do all of the above by creating win-win-win-scenarios for grid operators, consumers with flexible demand and generators who can adjust their output. We have therefore networked a portfolio of flexible generation and loads by aggregating a large number of participants who are willing and able to respond to price signals of the VPP’s control system. The price and control signals are submitted wirelessly using a remote control unit called the “Next Box” – learn more in this article.

Ancillary services or control reserves, which are tendered by the transmission system operators (TSOs), stabilize the grid between 49.8 and 50.2 Hz in Europe. While this was quite simple with only a few dozen large thermal power plants in the market earlier, the millions of decentral units in the system today create a complex optimization problem. Next Kraftwerke solves this by processing the collected data transmitted by the Next Boxes: Along with weather and price signals, the validated data are fed into an optimization scheme that determines the optimal output value for each unit. The control system then sends signals back to the Next Boxes installed at the decentral units which adapt their output accordingly. This system does not only work with producing units but also with large commercial and industrial customers with flexible loads.

The basic idea behind Next Kraftwerke’s business model is simple:

Produce electricity when it is scarce and consume electricity when it is plentiful.

Price signals from day-ahead and intraday markets, monitored by Next Kraftwerke’s trading team, offer incentives for flexible power producers and consumers to shift generation and consumption: for producers to periods of power scarcity with high prices, for consumers to periods of excess supply with low prices. The price signals, coming in real time through M2M communication, form the basis for adjusting consumption and production on a quarter hourly basis.

The value of flexibility for producers and consumers

One of Next Kraftwerke’s customers, for example, is an association for coastal management situated on the northern coast of Germany. Its main task is to pump rainwater seeping into the embankment back into the sea in order to avoid flooding of the marshland beyond. Once this customer had set the parameters for shifting the pumping loads, optimized pumping schedules are sent to them automatically and they can decide to follow it or not. By doing this, their electricity bill was reduced by 30% of energy costs without any adverse impact one the management of water levels. This particular product is called “Best of 96”, because each day has 96 quarter hours in which power consumption can be shifted; “best” refers to the cheapest electricity prizes. For customers who do no not have as much flexibility as to shift in quarter hourly periods, Next Kraftwerke offers a tariff in which daily price zones are fixed so customers can opt to shift their consumption to the regular low-price windows. Due its more static, structural optimization, the rate is called “Take your Time”.

The same principle applies to clients with flexible generation, such as biomass or hydro plants: By receiving price signals from the control system they can ramp up in periods of power scarcity (high prices) and ramp down in periods of excess supply (low prices). Because every plant has its own level of flexibility and optimal runtime parameters, all of the processes involved in the plant’s operation are analyzed by Next Kraftwerke’s team to determine the range of flexibility and its best application for each power plant.

What does the future hold for energy markets?

Founded in 2009, Next Kraftwerke has enjoyed explosive growth. In 2017 the company has over 4,500 decentral units under management with a power output of 3,200 MW, controlled by its highly automated central control system in Cologne, Germany. The control system adjusts the aggregated generation and loads according to current market prices, grid congestion and weather data using its Next Box System. The rapid rise and success of Next Kraftwerke can be traced back to two valuable services, increasingly sought after in markets with high renewable penetration:

- Aggregating output of its generators and selling it in various short-term markets, e.g. EPEX SPOT

- Optimizing flexible capacity of its customers on various balancing and spot markets (primary, secondary and tertiary control reserve, day-ahead and intraday markets)

Next Kraftwerke’s co-founder Hendrik Saemisch envisions that VPPs will enable Germany to reach its ultimate goal of “100% renewable energy at a reasonable price”. He is also convinced that the European electricity market designs tend to converge over the next five years, offering a huge opportunity to sell Next Kraftwerke’s grid services across the continent. The company’s recent expansions into Austria, Belgium, France, Poland, the Netherlands, Switzerland and Italy show its international ambitions.

More to read

We believe that when nuclear and coal/lignite plants are gradually closed down, allowing market prices to move freely, there will be sufficient market incentives for setting up decentral, green flexibility options of renewable generation as well as running existing loads more flexibly to absorb scarcity and excess situations and supply the short-term flexibility in between. The flexibility principle of the future energy market will then be: first shift, then store.

Conclusion

Europe’s electricity markets will gradually converge to form an electricity market in which hydro plants from Norway, Austria and Switzerland and solar farms in the Iberian Peninsula and Italy provide power to central Europe in times of scarcity. At the same time, the flexible capacity of Europe’s electricity consumers will be activated – supply and demand will dance with each other to find a perfect balance.

This complex and delicate dance of millions of decentral units will have to be choreographed by a digital utility in the center. Next Kraftwerke has sought out this role and developed a successful business model around it. It is thrilling to speculate how this vision might unfold and how the concept of variable demand responding to prices might evolve over time.

*Mc Kinsey 2014: „Beyond the storm – value growth in the EU power sector.“

This text is an excerpt from an essay by Helen Steiniger, Next Kraftwerke:

“Virtual Power Plants: Bringing the Flexibility of Decentralized Loads and Generation to Power Markets”

published in: Sioshansi, Fereidoon P. (ed.), “Innovation and Disruption at the Grid’s Edge”, Elsevier Academic Press, Chapter 17, (p. 331-362)