The big sellout at the Control Reserve Market

How the mixed-pricing system turns the security of the electricity grid into a speculative mass: On the sixth, 12th and 25th of June 2019, market distortions occurred in Germany; some of which had severe effects on the electricity grid.

Table of Contents

- Where did the electricity grid deficit come from?

- The search for additional electricity

- The way how the price per Megawatt for control reserve power exploded

- How control reserve has been devaluated

- Increasing grid usage fees

- The threat to power grid security

- Conclusion: The introduction of a new control reserve market system is urgent

When the last reserve disappears, things usually become stressful: it was precisely this experience that the German transmission grid operators (TSOs) made on the aforementioned days in June, when they wanted to compensate for an undersupply of the electricity grid with the help of control reserve energy: The 3,000 megawatts of positive control reserve power (mFRR) that the control reserve market keeps in reserve for such cases was offset by about twice the amount of demand, which of course had to be compensated immediately.

Where did the electricity grid deficit come from?

The first explanation is: Nobody knows. The Federal Network Agency (Bundesnetzagentur, BNetzA) and the TSOs have declared that they are examining the cause in the next few weeks. However, there are several possible explanations: It was very hot almost all over Germany, especially in the last week of June: The increased demand for electricity from air conditioning systems and the power reductions of thermal power plants due to heated cooling water are recurring factors that we were already able to observe in the summer of 2018.

The second explanation is systemic in nature and based on the peculiarities and structural errors of the mixed-pricing system in the control reserve market – this is what we try to clarify in this article under the section "The threat to power grid security".

The search for additional electricity

The TSOs turned every stone in search of additional electricity: They bought electricity on the intraday market, put the shutdown regulation (Abschaltverordnung, AbLaV) for large electricity consumers into effect and requested additional electricity supplies from other European countries. The transmission system operators were prudent and confident in averting worse consequences, but the lack of electricity was serious and found an astonishing media response considering the the ususally not very popular topic of grid frequency control measures: Terms such as "blackout danger", "lack of electricity", "chaotic conditions in the electricity grid" and much more got more and more into the headlines all over Germany.

Responding tothe increased demand, the transmission system operators doubled the tendered volume s in positive mFRR to around 2,000 MW. However, this resulted in another undesirable effect – the appearance of a new, sheer utopian price peak on the control reserve market.

The way how the price per Megawatt for control reserve power exploded

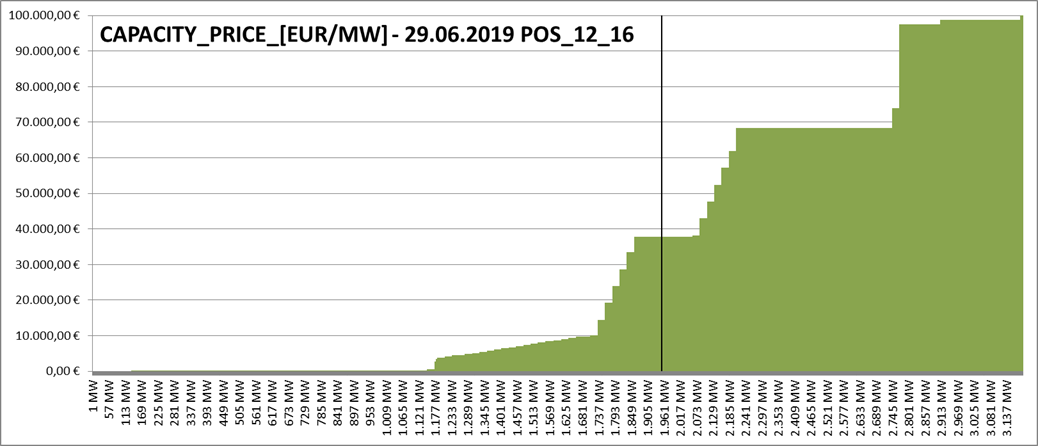

The price peak in question of 37,856 euros for a megawatt of positive mFRR occurred on 29 June 2019 in the block from 12 a.m. to 4 p.m. – for comparison: in the previous time slice from 8 a.m. to 12 p.m., the marginal price was only 152.01 euros.

A market player put 200 MW onto the market, was awarded the contract for 96 MW and earned an estimated amount of 3.5 million euros. The high price was due to both the increased demand and to the bidding strategy of the market player: He offered his standard power at ultra-high prices when demand exceeded supply – but the TSO as customer, driven by the grid situation, could not act differently than to accept this overpriced offer.

The process in detail: The chart below documents the course of the bidding process in question. It shows the control reserve quantity on the X-axis and the price per MW on the Y-axis. The bid in question was the last one accepted at a price of 37,856 euros – the black line in the diagram marks the tendered volume.

On the other hand, there was still considerably more mFRR in reserve – this is reflected in the ever increasing bid price and the bid quantity even after the tendered volume had been reached. If the tendered volume of the positive mFRR had been increased by an additional 1,000 MW by the TSOs at the end of June, the bidder could have earned almost 100,000 euros for the last megawatt - the quantity was obviously available and indeed it had been bid.

It is exactly this dominant market position of a small number of players due to their large mFRR portfolio that poses another problem for the functioning of market mechanisms, electricity customers, renewable energies and all smaller participants in the control reserve market: the sheer market power that gives the possibility of providing such a control reserve power quantity leads to the market distortions and price excesses described above. Which market player has such quantities of control reserve power in stock? Everyone can answer this question by himself.

How control reserve has been devaluated

In order to understand the following paragraph correctly, we need to explain some details in advance: The energy price for delivered control reserve energy has been reducedby the mixed-price procedure, while the capacity price has become more expensive. In a nutshell: The mixed-pricing system has increased the capacity price, while the energy prices, which are only paid when control reserve is called for, have fallen.

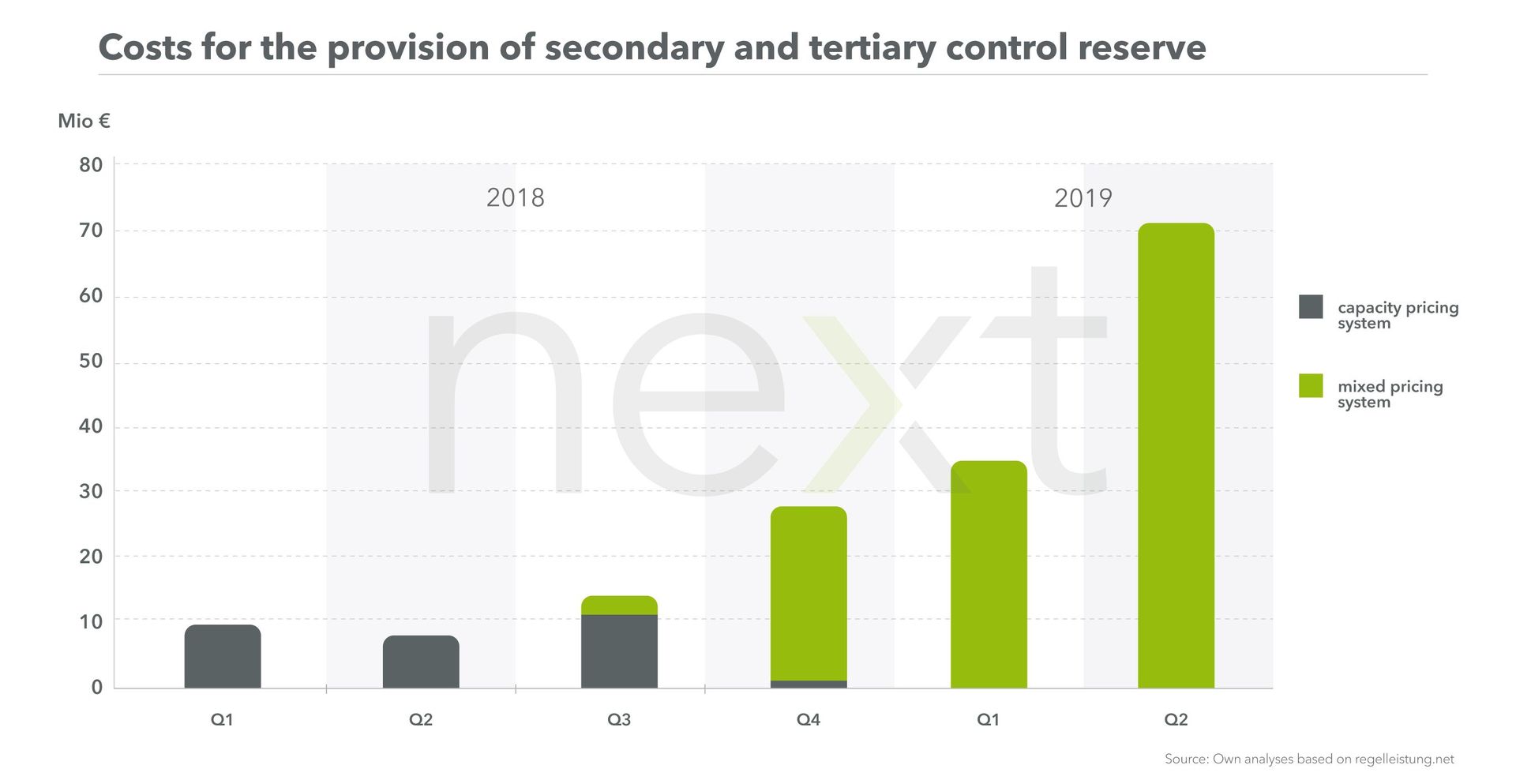

Increasing grid usage fees

The interplay of expensive capacity prices and cheap energy prices is creating an additional burden for all grid users, including regular household customers: The costs for the provision of control reserve power, i.e. the capacity prices, are paid from the grid fees allocated to all grid users. By the way, the average household customer also pays the above-mentioned extreme prices on Saturday, 29 June 2019.

The threat to power grid security

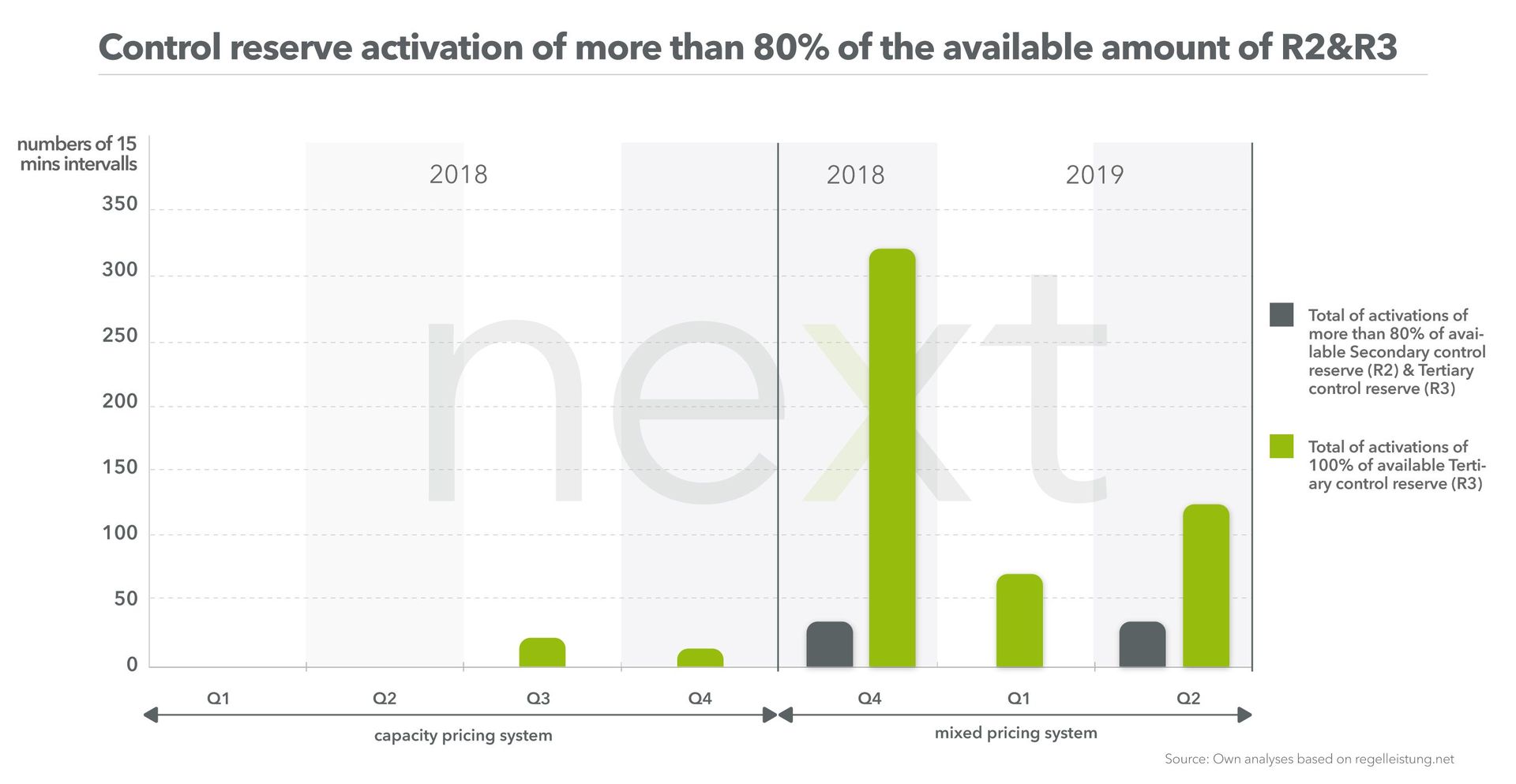

Grid security has gotten under pressure, because the prices at the power exchange are higher than the costs for control reserve power. A condition that has been introduced by the mixed-price system. This results in situations, where relying on control reserve power is more lucrative than buying additional power on the intraday market or by improving one's own forecasts. In other words, there are fewer incentives for balancing group managers to continue investing in forecast improvements in order to keep their own balancing group balanced.

Read more

Together, all these details exhaust the control energy market, which was designed for granular corrections of the power grid only. Due to the actually unnecessary calls, which were considerably more extensive due to the favorable energy prices, the reserve was quickly depleted and the electricity shortage occured. Just to keep in mind: on the sixth, twelfth and 25th of June 2019, the demand for control reserve power amounted to a maximum of up to 6,000 megawatts with a reserve of only 3,000 megawatts of positive mFRR available. Since the introduction of the mixed-pricing system, the situation of unusually high demand on the control reserve market has already occurred several times – pushing the grid was repeatedly to its limits.

Conclusion: The introduction of a new control reserve market system is urgent

The developments of the control reserve market in the mixed-pricing system were no surprise neither to us nor to other market participants. Instead of promoting a balanced, fair system for all market participants, a functioning system has been structurally damaged by the introduction of the mixed-pricing system by the Federal Network Agency – with all economic consequences.

Whereas in the second quarter of 2018, prior to the introduction of the mixed-pricing system, the costs for electricity customers to maintain the system amounted to only 7.5 million euros, they increased almost tenfold in the second quarter of 2019. This additional expenditure will be added to the grid usage fees, which in turn will make electricity prices more expensive. Who will then be made to liabe in the public for these price increases? It is foreseeable that the green scapegoat will soon be bleating again...

More information and services