The Corona crisis and the electricity market

The COVID-19 pandemic shakes up the world – but the power grid in Europe remains stable. What ensures this stability and how do the electricity markets in Germany and Europe react to the situation?

What is happening these days and weeks is without historical precedent. Our entire civilization is hitting the brakes with full force. We reassign our priorities - in life, in the economy, in politics. Still, the most important things in daily life remain possible - thanks to people who often receive little recognition and even more often low salaries. In hospitals, nursing homes, at supermarket checkouts, in the logistics industry – in short, in all systemically relevant professions that do not allow working from home, where people have to face the risk of infection on a daily basis. What these people do is outstanding and deserves our respect.

As far as our Virtual Power Plant is concerned, the current events do not endanger our operations - everything is business as usual with the exception of working from home instead our headquarters.. The networked power plants generate electricity; we sell this electricity on the power market and the balancing energy market. The data connections between our assets, the control center and the markets remain stable and working. We carry out our part in ensuring stability in the grid – together with hundreds of thousands of small and large, renewable and non-renewable power generation plants in Europe.

The modern, decentralized power grid is built very similar to the internet, which is very resilient to major disruptions. Its basic technology, designed in the 1960s in response to the centralized computer networks that were severely threatened during the Cold War, offers detours when direct routes are closed. Sun and wind deliver electricity very reliably and largely independent of human intervention. How important functioning structures are, especially how important redundancies and reserves are for every system, becomes abundantly clear these days.

Concepts such as decentralization, digitalization, automatic data exchange and the German KRITIS (refers to ISO 27001) regulation for the protection of critical infrastructure, with whose criteria we comply, are currently proving their worth in our everyday lives. We can operate our servers and workstations from our desks at home just as well as if we were sitting right next to the server room - with the exception of a small team, nobody has to work in our building now. Video conferences have taken over our daily meetings - as in many other companies.

Reactions of the electricity market to the Corona crisis

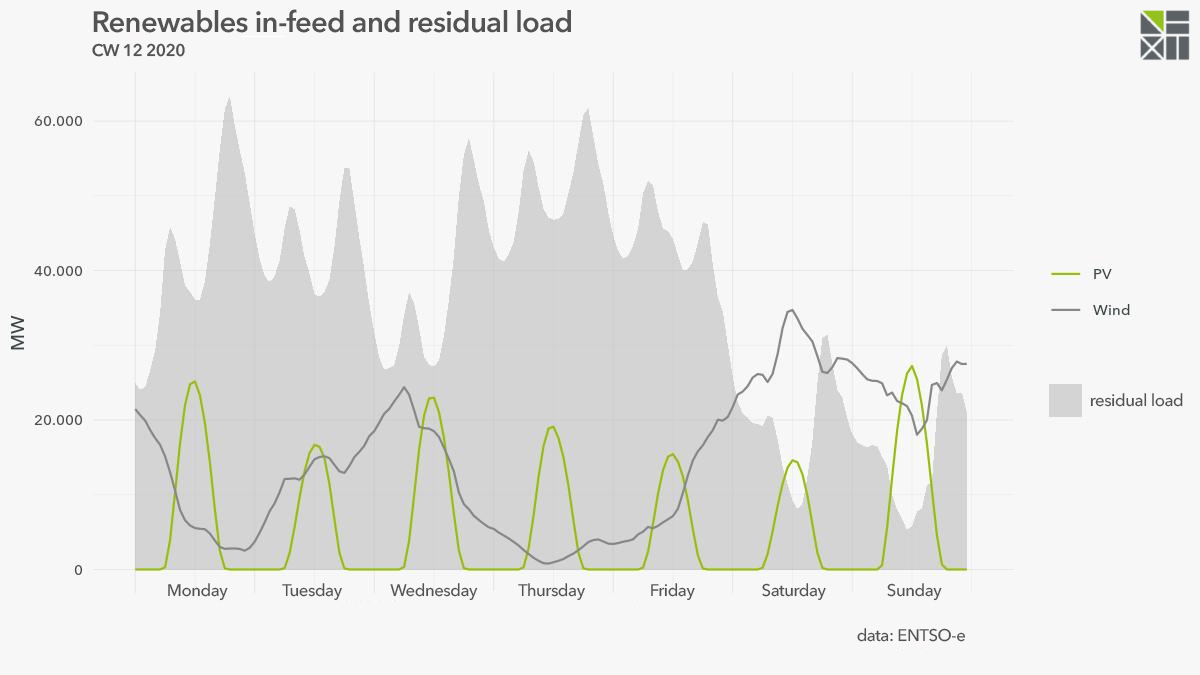

The principle of supply and demand organize the electricity market – though demand has partly collapsed due to shutdowns in global industrial production. Automobile factories and many other production plants have ceased production or reduced it to a minimum; in Italy, the country that faces the most severe casualties, all "non-essential companies" are closed. Industry and commerce normally consume almost half of the electricity generated in Germany – so naturally, electricity is now abundantly available at a very low cost.

However, as our in-house power traders report, the effects of low prices are modest compared to the load shifting activities in the market. Normal habits of German electricity consumers such as getting up early in the morning, turning on the light, taking a shower, switching on the coffee machine and much more do not take place due to the restrictions and curfews. The characteristic peaks, i.e. the maximum consumption values, are hardly visible in the price profile of a currently normal day on the intraday market. Our electricity traders therefore have to adapt to a new situation in power trading which they have not encountered during their training or in their everyday working life so far.

Overall, the consequences in short-term trading, which is Next Kraftwerke’s main area of work, are not as serious as in long-term trading. The heavy drop in fossil fuel prices has a severe impact here; hard coal prices plunged by about 25 percent and oil prices by about 30 percent. Long-term contracts with terms that are based on long-term forecasts of raw material price developments cannot be maintained as a result of this drop in prices. The collapse in oil prices is directly noticeable at the pump; price slumps of comparable magnitude, albeit less severe, were last observed during the global financial crisis in 2008 - gas prices will also fall sharply with a time lag.

Negative control energy in strong demand

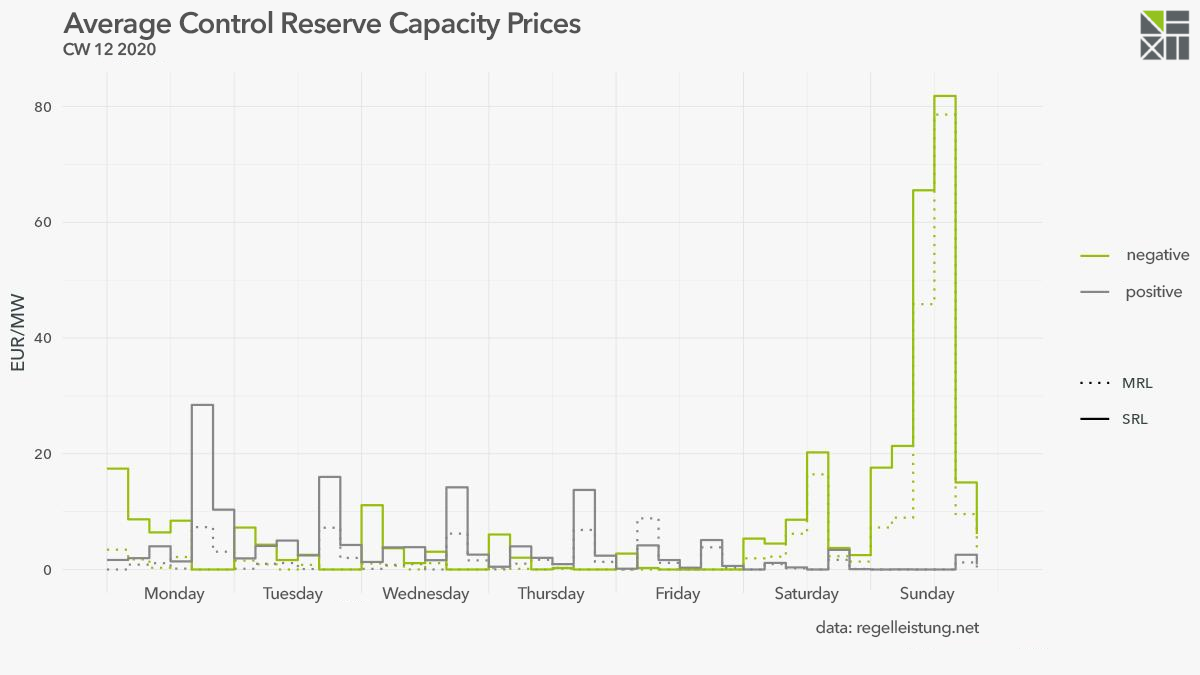

The enormous decline in electricity consumption also shows clearly on the balancing energy market. For example, the price for negative secondary and minute reserve power rose sharply last weekend, as grid operators had to withdraw surplus power from the grid by using large quantities of negative secondary control power (or Automatic Frequency Restoration Reserve, aFRR) and tertiary reserve power (or Manual Frequency Restoration Reserve, mFRR).

Normal power prices for negative aFRR and mFRR are in the single-digit euro range - on Saturday (21 March 2020), however, prices initially rose to 20 euros per MW, and then on Sunday to a record of 80 euros/MW. The grid operators bought large amounts of negative control energy for the expected drop in electricity consumption on Monday.

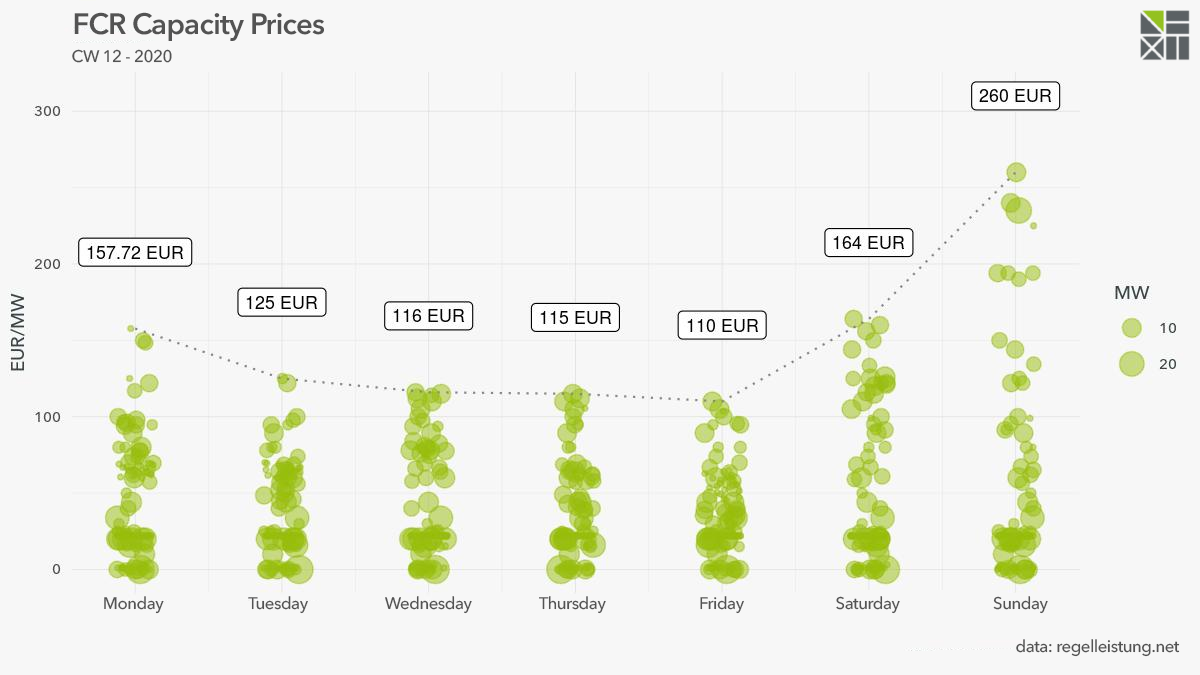

The primary balancing power (or Frequency Containment Reserve, FCR), for which there is no differentiation between negative or positive products and which continuously balances the grid frequency, achieved much higher prices, too. On Saturday (21 March) FCR prices were at164 euros per MW, on Sunday at 260 euros/MW. There was no turbulence on the control energy market, apart from the sharp increase in demand for negative control energy. After all, the balancing energy system is designed for precisely these cases.

Read more

What happens next?

As far as the post-corona social and economic situation is concerned, we can only say, we have no idea. Based on the current situation, our Virtual Power Plant could continue for a theoretically unlimited period of time. After the first week, our work routines under shutdown conditions are up and running. Our team has become accustomed to the situation; however, it is strange for us not to see our colleagues in person at least once a week.

On the electricity market, the market participants have also already adjusted to the new situation. The market operations have been running digitally and by telephone for years. The power system counters the current situation of oversupply quite easily by negative control energy and shutdowns of electricity generators.

We ourselves, like everyone else, remain in our private homes and continue to monitor developments, both in the electricity market and in the corona crisis. What reassures us is that the sun is shining, the wind is blowing strongly, and renewables are contributing to grid stability even during the crisis. At least from our point of view, the electricity supply is secure.