What is Frequency Containment Reserve (FCR)?

Definition

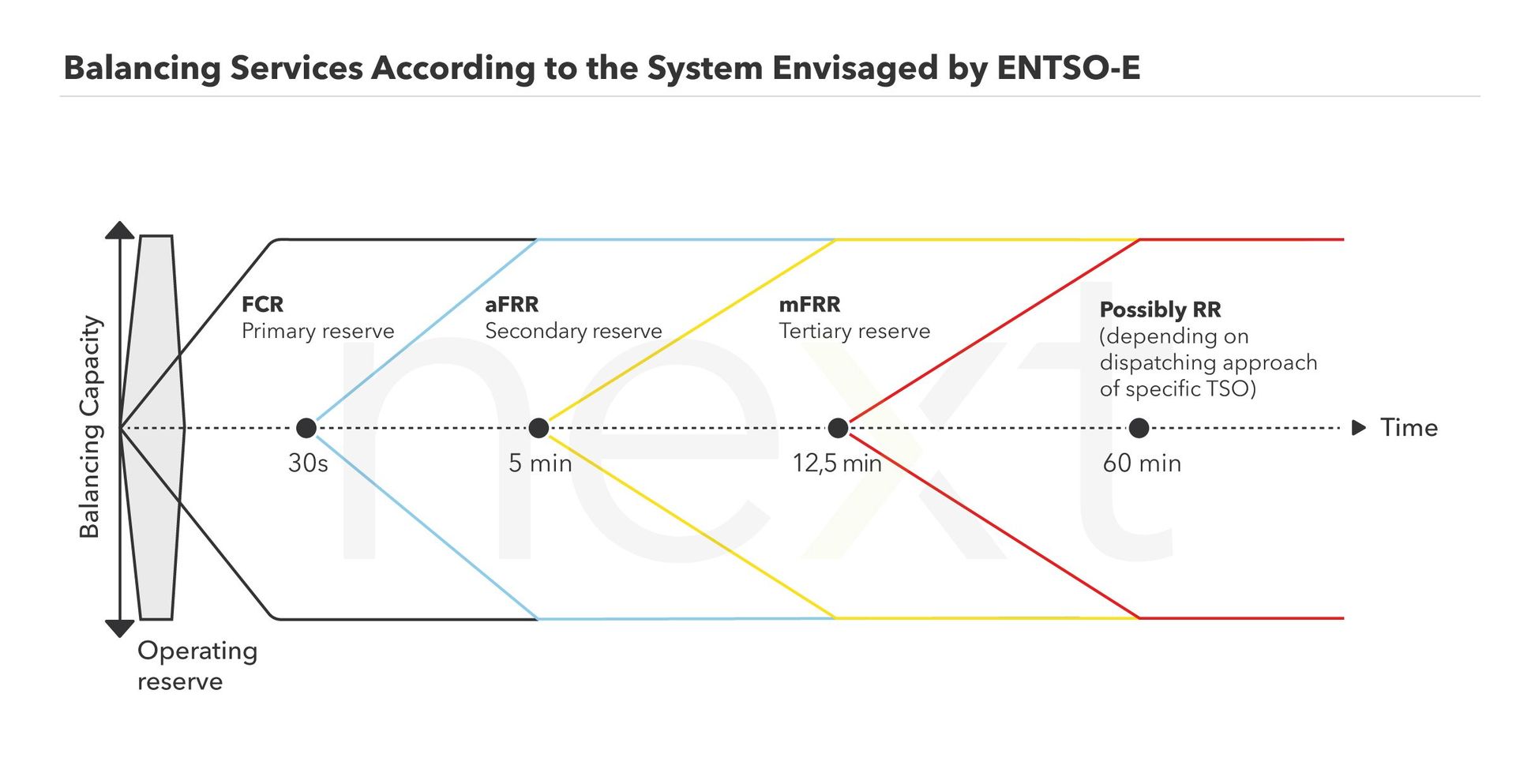

To ensure the required grid frequency of 50 or 60 Hz (depending on the concerning country) the Transmission System Operators (TSO) of each country need instruments to maintain this reference value. These instruments are the balancing services. Balancing services are reactive short-term means to level out frequency deviations in the power grid. When frequency deviations occur, e.g. in consequence of a power plant outage, the Frequency Containment Reserve (FCR) intervenes automatically within seconds in the entire synchronous area to restore the balance between supply and demand. The FCR, also known as primary control reserve, is the first response to frequency disturbances. If the deviation persists, the Automatic Frequency Restoration Reserves (aFRR) subsequently replace the primary control reserve.

Why do we need the FCR?

The FCR serves among other balancing services as a safety mechanism for Continental Europe and is responsible to adopt to short-term imbalances between energy consumption and generation. The frequency containment process steadies the frequency, which is directly affected by the equilibrium of consumption and production, within a permitted range of the rated value of 50 or 60 Hertz. The compliance of this set point is crucial to maintain a stable grid security. If e.g. a large power plant causes a technical failure or the prognoses of volatile power producers deviate significantly from the generated output, the frequency changes. Hereby, the FCR represents the fastest measure to counteract the discrepancy.

Regulatory hotchpotch

It is rather complicated to discuss in general terms the different balancing service markets such as the FCR on a global scale, since it is implemented in various ways depending on the system operator’s approach or the design of the electricity market. Some countries such as the U.S. operate electricity markets with a nodal pricing structure – and partly vertically integrated utilities. Other countries such as Germany show liberalised markets with zonal pricing approach. Naturally, the general concept of operating an electricity market also affects the markets for balancing services. However, physical product specification such as activation speed or duration are very often comparable. For the sake of explaining the general concept, here, we decided to focus on the regulations for the FCR outlined by the ENTSO-E (the European Network of Transmission System Operators of TSO in Europe). In particular, the SOGL (System Operation Guideline) and the Electricity Balancing Guideline (EB-GL) contain the regulatory details. The participating ENTSO-E members in the FCR are forming the FCR Cooperation.

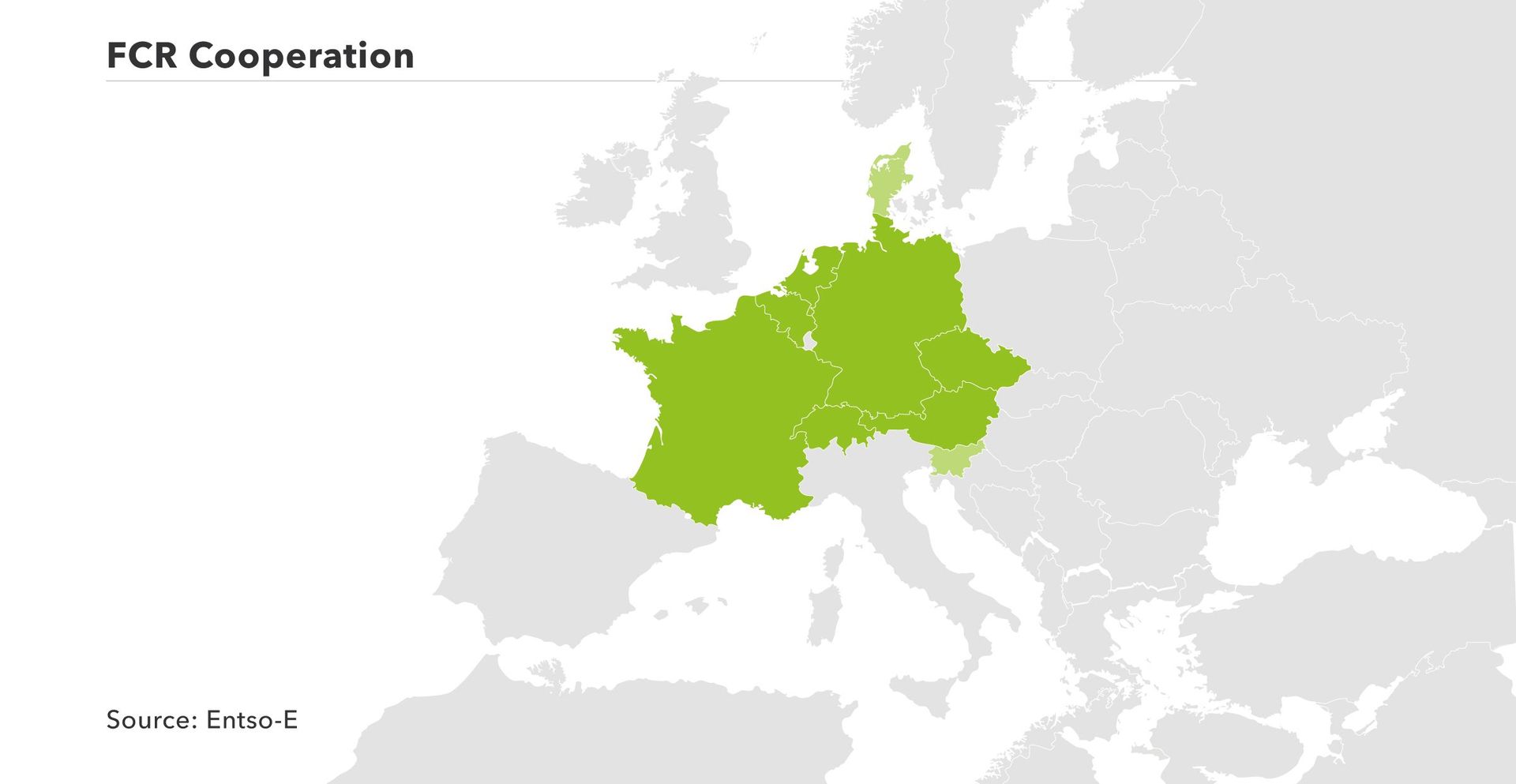

What is the FCR Cooperation?

The FCR Cooperation derives from the EU´s objective to facilitate and ensure a uniform electricity balancing energy trading throughout Europe according to the EB-GL. Thus, the European Commission hopes to create a more efficient and reliable electricity distribution. Currently eleven TSOs from eight countries are forming the FCR Cooperation. This collaboration represents a common market for procurement and exchange of FCR within the European members. If a shortage of energy in the control area of one of the member TSO causes a frequency drop, the FCR capacity of the whole cooperation can be used to balance the grid and counteract the frequency deviation.

| FCR Cooperation member | TSO |

|---|---|

| Austria | APG |

| Belgium | Elia |

| Switzerland | swissgrid |

| Germany | 50Hertz Amprion TenneT DE TransnetBW |

| Western Denmark | Energienet |

| France | RTE |

| Netherlands | TenneT NL |

| Slovenia | ELES |

| Czechia | ČEPS |

The same principle applies with an abundance of energy. The objective of the FCR Cooperation is to improve the balancing market conditions of the primary control reserve considering e.g. competition efficiency and transparency while preventing inadmissible frequency deviations.

When and how is the FCR activated?

As the FCR reacts to short-term frequency imbalances in the grid, the complete activation of the frequency reserve must be available within 30 seconds and cover a period of 15 minutes per incident according to ENTSO-E standards.

Participants of FCR procurement are obliged to provide the volume tendered when the frequency deviation is outside the given deadband between 49.99 Hz to 50.01 Hz. The activation runs automatically, nonselective and frequency controlled within the synchronous area of the FCR Cooperation. Suppliers of the FCR measure the grid frequency independently at the location of power consumption or generation and reply directly to frequency change. The aFRR gradually replaces the FCR after half a minute. To ensure the grid stability in the Continental Europe synchronous area, an amount of 3000 MW positive and negative primary control reserve is constantly ready for activation. This amount represents the cumulative power of the two largest power plants in the grid area. That derives from a specification of the Guideline on Transmission System Operation (SOGL).

How is the market design and what is the volume of FCR Cooperation?

The market design derives from the interaction of the TSOs of the ENTSO-E and the responsible government authorities. The TSOs propose market design requests of the FCR procurement and its conditions to the government authorities. They must approve the propositions before the suggestions enter into force. The area of the ENTSO-E determines the required demand of FCR. Since the ENTSO-E area is a synchronous area, the provision of the balancing energy is distributed in solidarity among the participating TSOs. That means that every Load Frequency Control area (LFC area) provides FCR volume based on the arranged annual allocation key.

More to read

What are the auction terms?

The auction takes place daily with six four-hour products. The procurement applies for the following delivery day. The call for FCR tenders is executed every day at 8 am (Central European Time). Bids in the auction are symmetric, which means that the providers of the offers must procure the same volume of positive as well as negative primary reserve. The responsible TSO of each nation pools all offers within their country and sort those in a common merit order list. Hereby the required volume of FCR is auctioned for suppliers with the cheapest offers. Divisible bids and indivisible bids constitute the two approved bidding possibilities in the FCR procurement. Whereas the indivisible bids cannot exceed a maximum of 25 MW among all market participants.

In contrast to the pricing conditions of the aFRR and mFRR (manual Frequency Restoration Reserve) , where the compensation is divided into capacity price and energy price, only the capacity price rewards the providers of FCR products.

The online platform www.regelleistung.net provides tender details and the bidding terms. On this website, all prequalified participants can compete in the FCR auction. Here, the bids must contain the offered volume and the capacity price. Due to the marginal pricing principle, every bidder receives the price of the last auctioned bid in the merit order list. Each of the remaining providers of FCR are obliged to hold and potentially activate the auctioned volume.

At a glance:

| Bids | Symmetric, Divisible/indivisible |

| Minimum bid size | 1 MW |

| Resolution | 1 MW |

| Maximum bid size (indivisible bids) | 25 MW |

| Auctions | 6 * 4 hours slices per day |

| Activation | Frequency-controlled within max. 30 seconds |

| Period to be covered per incident | 15 minutes |

| Compensation | capacity price |

| Activation area | Entire synchronous area |

| Deadband (Continental Europe) | ∆f = ±10 mHz: from 49.99 Hz to 50.01 Hz |

What is the FCR Volume?

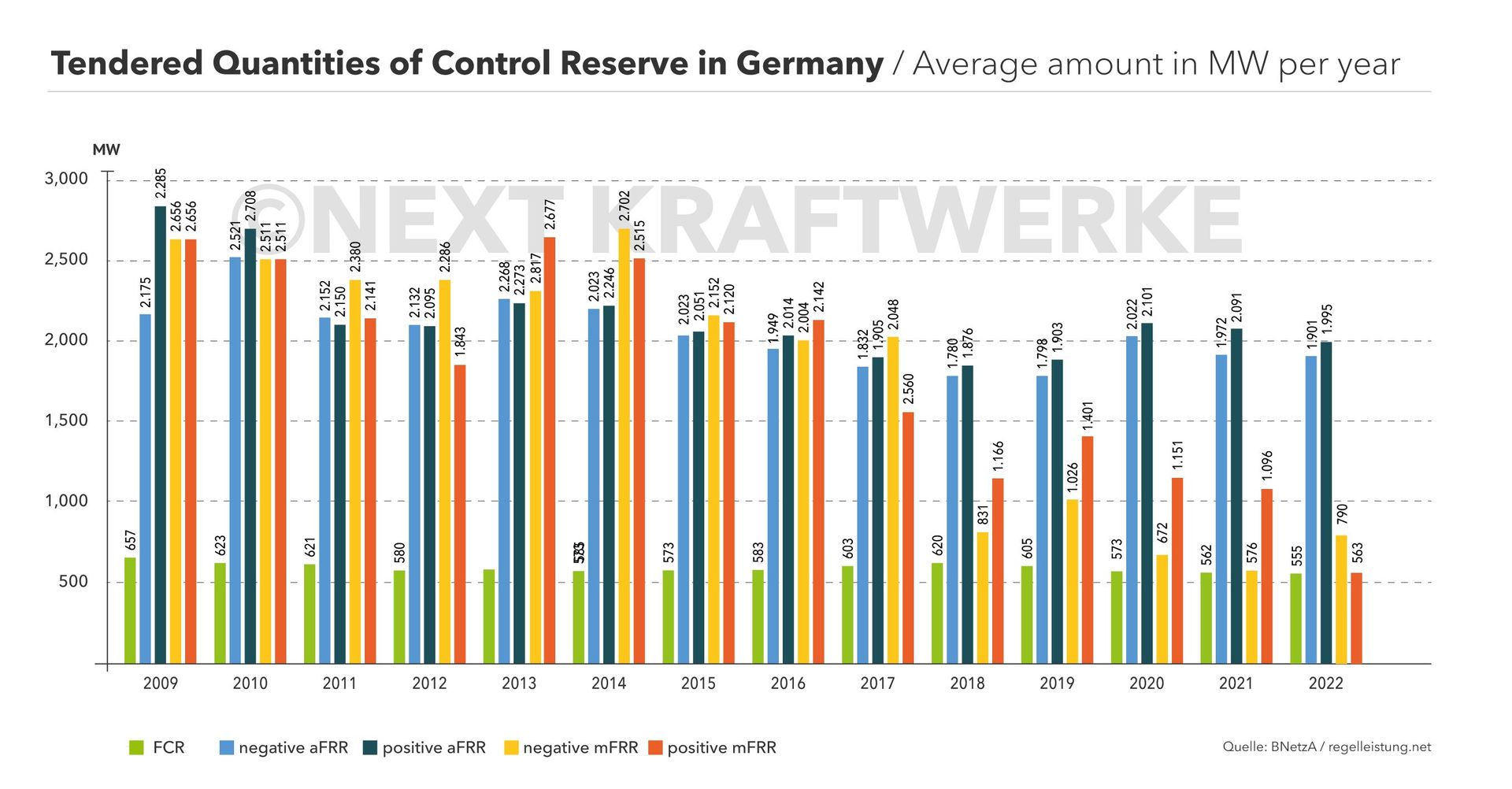

Each member of the FCR Cooperation shows a different demand of primary reserve and different technical possibilities to supply primary reserve. Thus, the volume of FCR demand, core share and export limit vary among the participating countries. Germany e.g. presents a FCR demand of 562 MW while Slovenia´s demand is at 15 MW for 2021. The volume is adjusted every year on basis of the power input of the previous year. The given table demonstrates the demand, core share and export limit for the year 2021.

The core share describes the minimum amount of FCR within each LFC area that every country must provide. The volume of the core share is 30 % of the FCR demand. As per requirements, the export limit represents the maximum volume of primary reserve, which is transferred to other LFC areas within the FCR Cooperation. The share is also 30 % of the FCR demand but at least 100 MW (except Western Denmark due to IT limitations).

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.